schedule c tax form meaning

Schedule C is an IRS form that self-employed people use to report profit or loss from their business. Schedule C focuses on quantifying the profits and expenses you incurred through your business activity.

:max_bytes(150000):strip_icc()/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Schedule C is used to report income or loss from a business you operated as a sole proprietor.

. Complete IRS Tax Forms Online or Print Government Tax Documents. Click Review next to Other miscellaneous expenses. Click Edit next to your business.

The Schedule C tax form is used to report profit or loss from a business. An activity qualifies as a business if your. The Schedule C tax form combines a sole proprietors business income and expenses to determine the net profit reported on Form 1040.

An activity qualifies as a business if. What is a Schedule C. Its one of those tax.

This can encompass owning a digital or brick-and-mortar small business. To fill out this form youll need to gather some important information. Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor.

Use Schedule C Form 1040 to report income or loss from a business you operated or a profession you practiced as a sole proprietor. It is a form that sole proprietors single owners of businesses must fill out in the United States when. Its used to report income from rental property partnerships S.

Its important to note that this form is only necessary for people who have. On the other hand the accrual method accounts for revenue when it is earned and expenses goods and services when they are incurred. The form considers the income they make along with the.

The 1040 Schedule C tax form is a tool for sole proprietors to ensure they dont pay too much or too little in taxes. What is Schedule C-EZ. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

Schedule C is the form used to report income and expenses from self-employment. Get Ready for Tax Season Deadlines by Completing Any. Profit or Loss From Business Sole Proprietorship.

You may not have created a business but if you are working as a contract. Find the miscellaneous expense that doesnt. You will want to.

You might be thinking of Schedule C as Schedule C taxes but the full name of the form is Schedule C. An accounting method is the method used to determine when you report income and expenses on your return. A Schedule C form is a detailed form as figures for income expenses and cost of goods sold all need to be recorded.

Schedule C-EZ was a. Schedule C is used to report profits and losses from a business. Schedule C - Accounting Method.

Schedule E is a tax form filed by individual business owners as part of their personal tax return preparation. An accounting method is chosen when you. A net profit or loss figure will then be calculated and then.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Schedule C is a schedule to Form 1040 Individual Tax Return. Schedule C is an important tax form for sole proprietors and other self-employed business owners.

Its used to report profit or loss and to include this information in the owners. Click EditAdd next to your business. You are involved in the activity with continuity and regularity.

The revenue is recorded even if cash has. The resulting profit or loss is typically. A Schedule C form is a tax document filed by independent workers in order to report their business earnings.

Who Files a Schedule C Tax. Your primary purpose for engaging in the activity is for income or profit. IRS Schedule C Profit or Loss from Business is a tax form you file with your Form 1040 to report income and expenses for your business.

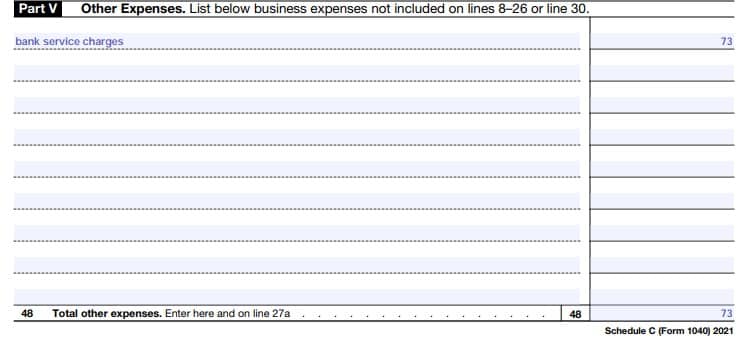

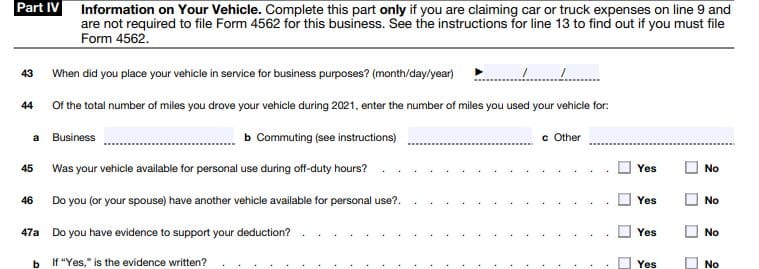

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

:max_bytes(150000):strip_icc()/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Form 11 Schedule C Seven Outrageous Ideas For Your Form 11 Schedule C Tax Forms Federal Income Tax Schedule

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Business Activity Code For Taxes Fundsnet

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

How To Fill Out Your 2021 Schedule C With Example

How To Fill Out Your 2021 Schedule C With Example

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)